October’s budget has serious implications for businesses, effectively making it more expensive to employ people. But don’t despair – there are plenty of smart ways to cut costs while still delighting and engaging your people.

The increased National Insurance contributions and National Minimum Wage rate will hit at the same time in April 2025, representing the biggest change to employment law and costs for 25 years. Newsfeeds are full of doom and gloom messages about rising wages and inflation-squeezed budgets. But there are intelligent, practical ways to manage these costs effectively without sacrificing employee satisfaction or business growth.

Here’s how to stay on top of your employer costs while keeping your team happy and productive.

What’s changing

National Insurance contributions

National Insurance contributions

The UK Budget’s planned increase in Employer National Insurance (NI) contributions is a major change. Currently, businesses pay 13.8% NI on earnings above £758 per month (£9,100 annually). The hike, announced on October 30, 2024, will introduce a new rate of 15% from April 2025 and adjust thresholds down to £5000 pa (or £417 per month), potentially straining budgets in sectors with tight margins like hospitality, retail, and care services. This is especially impactful for businesses with large workforces or average pay at or above the national annual median salary of £34,963 (ONS Nov 23).

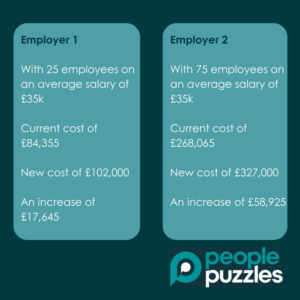

Using the UK Tax Calculator 2024-employers-national-insurance-calculator, here’s two examples of increased annual cost based on the average UK Salary with different headcounts

National Minimum Wage and employees under age 21

Labour has promised to phase out the 18-20 age band. The band currently allows employers to pay a lower hourly rate to under 21s.

Last year the NMW rose by over £1 to £11.44 in 2024 and with the Budget, the Chancellor announced that NMW will rise to £12.21 in April 2025 (6.7%) and specifically that the 18–20-year-old rate will go up by 16.3%, from £8.60 to £10.00.

No Waiting days – SSP from Day 1 of absence

If your business currently operates a sick pay system where the first 3 days off are classed as “Waiting Days” and are unpaid – this will change to SSP payment from the first day of absence. Although there is no confirmed date when this will be brought it, it is widely assumed to be April 2025.

Smart ways to make your team more productive

Since October’s budget, each employee effectively costs your business more, so it makes sense to look at ways that you can get the most out of your team and help every individual be more productive.

Right people right seats

Take a close look at the roles that you need to deliver your goals, both now and in the future. Ask yourself what skills, responsibilities and deliverables each role requires, then consider whether you have the right people in the right seats (otherwise known as organisational design). When people are in roles that match their strengths and interests, they are more likely to be happy, motivated and more productive.

Right-sizing is also important – business efficiencies may make it possible to achieve more with less resource, or to scale from a static base without increasing overheads.

Alignment

Does every member of your team know what the key business goals are and how their role contributes to achieving them? When everyone shares the same goal and is clear on the actions they need to take to achieve them, it reduces conflict and wasted time, and makes positive outcomes more likely. It is therefore really important to ensure that you are clear about your targets and what success looks like.

Goal setting and productivity tools

Do you know exactly how much time your people spend on different tasks? A 2022 report by McKinsey showed that organisations using quarterly goal-setting frameworks saw a 30% improvement in task completion rates and alignment with business strategies. So how do you achieve that in your own business?

This recent article on getting your workforce to deliver your strategy explains how consciously planning time to allow for the fire-fighting that comes with all jobs, as well as other core activities and development time, can lead to greater productivity.

Smart ways to get the team you need and cut costs

To achieve growth, you need to make sure that you have the right team in place to deliver your goals.

Hiring a full-time employee might not always be the most efficient way to get the expertise you need. Fortunately, these days there are plenty of more flexible options at your fingertips to help cut costs. You may wish to consider:

Fractional expertise

Whether it’s HR, finance, marketing, or IT, part-time professionals or consultants can deliver high-quality results without the commitment, risk or expense of a full-time hire.

Interim or project-based roles

For short-term needs, bringing in a specialist on a project basis or hiring seasonal roles can keep costs manageable and keep pace with demand without committing to a hefty payroll.

Outsourcing

Administrative tasks or niche skills can often be outsourced at a fraction of the cost of hiring in-house.

This approach ensures you’re only paying for what you need, freeing up budget to spend elsewhere, and de-risking your expenses. It can also be helpful if you have a recruitment freeze but beware of long-term contract tie-ins which can prove costly.

Smart ways to keep your best people

Replacing people is expensive. Advertising roles, interviewing, and onboarding take time and resources, not to mention lost productivity while getting up to speed. Plus, losing a key employee can hurt morale and productivity. The actual cost of replacing a member of your team can exceed 200% of their salary. Retaining your current team is one of the best ways to keep costs in check.

Offer development opportunities

Training and upskilling employees keeps them engaged and adds value to your business.

Provide clear career paths

Employees who see a future with your company are less likely to leave.

Upskill and develop your managers

One of the main reasons people leave businesses is through poor management so make sure your leaders are doing the right things to keep teams motivated and aligned.

Show appreciation

The simple act of thanking someone or publicly recognising them in front of the team goes a long way in boosting morale and loyalty without costing a penny.

Look after your employees’ wellbeing

Investing in wellbeing might seem counterintuitive when cutting costs, but healthier, happier employees are more productive and take fewer sick days. Initiatives like mental health support, flexible working, and promoting work-life balance can lead to long-term savings. It’s not just businesses facing a more expensive world – your people are most likely feeling the financial pressure too, so looking out for their wellbeing is incredibly important and is increasingly being taken into account by applicants when assessing which roles to apply for.

Smart ways to improve efficiencies

Take a close look at how your business operates and identify processes where improvements could reduce costs and increase efficiency – this is so important for productivity as it enables your business to scale without increasing resource.

Automate repetitive tasks

Use technology to streamline tasks such as payroll and expense management. It will save you time and avoid errors. There are loads of great options out there so it’s important to shop around to find the right systems to suit your needs, but they really can boost productivity and help you measure the difference too.

Consider hybrid working

Do all your team need to be on site? As well as reducing office overheads and improving productivity, remote or hybrid work is popular with many people who find it easier to juggle home responsibilities around work. This can also cut commuting time, reduce utility costs for the office, and create good feeling among your people, making it a real win:win.

Small changes to cut costs in your day-to-day operations can add up to significant savings over time.

Smart ways to mitigate the costs

By taking advantage of government incentives and salary sacrifice schemes, you may be able to offset some of the increased costs and still give your team something to smile about.

Offering tax-efficient benefits through salary sacrifice schemes isn’t just good for employees—it’s a smart move for your business too. These schemes reduce the gross salary on which National Insurance and tax are calculated, saving you money as an employer while costing less to you than a direct salary increase and still providing attractive perks to your team, making them a win-win.

You can find out more about salary sacrifice schemes in this recent article. Popular options to cut costs include:

Pension contributions

Employees can opt to increase the amount that they contribute to their pension from their pre-tax salary. This is known as an additional voluntary contribution (AVC), which boosts their retirement savings at the same time as reducing the amount that they and you pay in National Insurance.

Electric vehicle (EV) and cycle-to-work schemes

Help employees save on travel costs while supporting sustainability goals.

Private medical insurance

Employees benefit from improved healthcare access, and salary sacrifice makes it more affordable for everyone.

The government offers various incentives to help businesses manage costs, especially when it comes to hiring. Look out for schemes like:

Apprenticeship funding

You can train new talent while receiving government support.

Employment allowance

Eligible employers can reduce their NI bill by up to £5,000 a year.

Green grants

Thinking about embedding ESG (environment, social and governance) initiatives isn’t just the right thing to do by way of the planet and your people, there may also be funding or tax reliefs available.

Funding and investment

There are lots of opportunities in sectors such as renewable energy, construction and technology. Achieving investment isn’t always easy but with the right team in place and all the compliance boxes ticked, your business will stand out as a good, safe option. Investment often accelerates growth while alleviating financial pressure in the shorter term.

Don’t be afraid to ask for help

Running a business is challenging, and navigating rising costs can feel overwhelming. No one is expected to have all the answers, which is why bringing in part-time expertise as and when you need it, such as a fractional People Director, can help you cut costs and create a sustainable plan for the future. Rising employer costs don’t have to mean sacrificing quality or growth. By exploring tax-efficient benefits, optimising your workforce, and focusing on employee retention, you can reduce costs while building a thriving, motivated team.