Furlough Update – the Coronavirus Job Retention Scheme

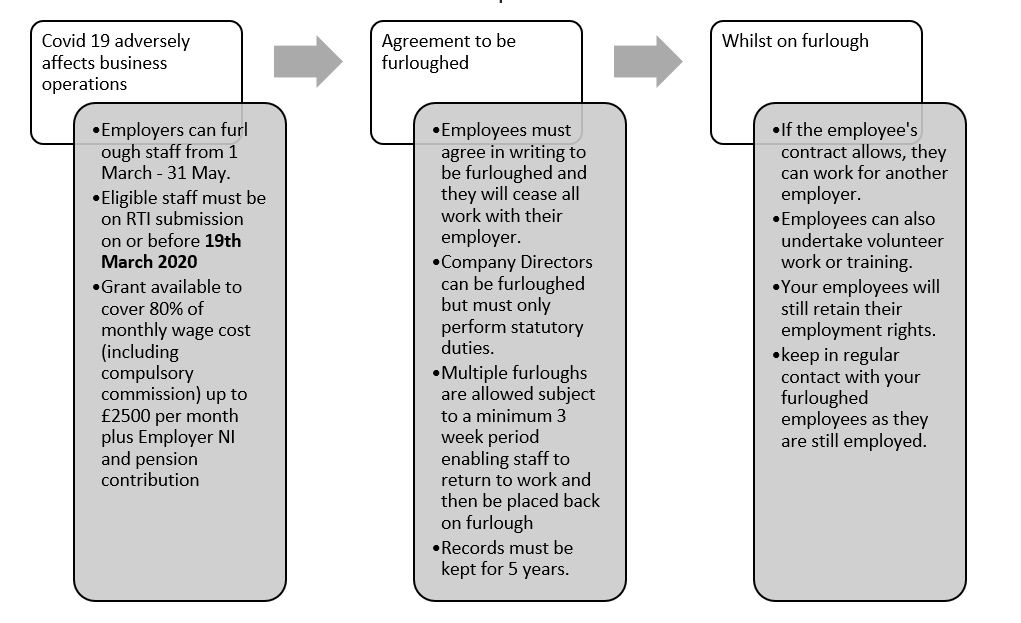

HMRC issued a further update this week on the Coronavirus Job Retention scheme helping to provide further clarification.

A brief overview of these revisions is below:

- Claim date: Employers can now claim for furloughed employees and Apprentices that were on their payroll on or before the 19th March 2020. HMRC will only consider employees included on their RTI (Real Time Information) payroll submission on or before this date.

- Business Transfers: staff who have been transferred to another company after 19th March 2020 may be furloughed and the new employer can claim even if they did not operate the payroll on 19th March 2020.

- Redundancy: Furloughed employees do not need to be at risk of redundancy to be considered for furlough. The only criteria for the furlough are that it is as a result of the Coronavirus pandemic.

- Overseas employees with a work visa: employees with an approved work visa may be furloughed.

- Employees who are ill: if an employee is self-isolating or absent due to illness, they cannot be furloughed and must receive SSP. Employees who are “shielding” for 12 weeks can be furloughed and receive payment under the Scheme, instead of SSP but they cannot receive both at the same time.

- Process to claim: the HMRC online portal will be available from 20th April 2020, and can be backdated to the 1st March, where employees have already been furloughed. Your employees’ salaries should be reduced to 80% within your payroll from the effective date of furlough, as HMRC will not make this adjustment.

Now is the time to start thinking about what you will need to do once the lockdown is lifted and the Government Scheme ends. Below are some questions you should be considering, to help start your planning.

Will all your furloughed employees be able to return to their roles?

Hopefully, you are able to bring all your team back to work. If this is the case, then you will need to confirm in writing to each employee that their furlough has come to an end and that their normal terms and conditions will apply from an agreed date. Don’t forget to readjust their salary back to the original amount.

Will you need to consider redundancies?

The pandemic may have had an adverse effect on your business operations, leading you to review your resourcing requirements going forward. Should you need to make redundancies you will need to consider selection criteria, and the consultation process to be followed and the timescales involved.

Is there an opportunity to consider restructuring your business, and if so, what does this look like?

There may be an opportunity to review your business strategy and assess whether your current business model will be fit for the future. Some considerations may be reviewing the skills you now need going forwards; whether the organisational structure is still relevant, or whether to diversify depending on market conditions. These are examples of the people related decisions on which you may wish to reflect.

We continue to provide updates and guidance on how to prepare for the future, but if you would like to chat it through with one our People Directors, please get in touch with us at [email protected] or call 0808 164 5826.