As an Employer what do you need to consider regarding the new Coronavirus Job Support Scheme

As you are aware the CJRS or Furlough scheme comes to an end on 31st October 2020 …. so what should you be thinking about now?

There will be two schemes running in parallel

Based on the increased restrictions announced on Monday 12th October The Job Support Scheme will be expanded to support businesses across the UK required to close their premises due to Covid restrictions (Tier 3 Restrictions)

Key facts for businesses which are required to close

– The government will pay two thirds of each employees’ salary (or 67%), up to a maximum of £2,100 a month.

– Employers will not be required to contribute towards wages and only asked to cover NICS and pension contributions.

– The Local Restrictions Support Grant scheme has been increased so that businesses in England can receive up to £3,000 per month, and are eligible for payment sooner, after only two weeks of closure rather than three. they are subject to restrictions and employees must be off work for a minimum of seven consecutive days.

– The scheme will begin on 1 November and will be available for six months, with a review point in January.

– In line with the rest of the Job Support Scheme, payments to businesses will be made in arrears, via a HMRC claims service that will be available from early December.

These measures will sit alongside the original JSS – which is designed to support businesses that are facing low demand over the winter months – and the £1,000 Job Retention Bonus (JRB) which encourages employers to keep staff on payroll

Questions for businesses who will continue to see a downturn in trade:

- Is our revenue less than pre-covid and likely to remain so over the next 6 months?

- Do we have employees still on furlough who we can’t afford to bring back full time?

- Do we have enough work for employees to do a minimum of 1/3 of their hours?

- Are there any employees who started after the furlough scheme commenced, who we may need to put on this scheme as we go into November/December if our revenue is predicted to decline?

- Do we have employees who still have childcare issues and this scheme may allow them to work reduced hours?

- Do we want to take advantage of the Job Retention Bonus in January 2021 and does this scheme allow us to retain people into 2021?

Below are 12 key facts about the new scheme that may help you answer the questions above.

However, this situational resource (and financial) planning can be complex, so we are offering business owners, CEOs and MDs a complimentary 30-minute call to discuss your bespoke situation, please get in touch with us at [email protected] or call 0203 239 3307.

Twelve facts about the new Coronavirus Job Support Scheme

1. When does the scheme run from and to?

It opens on 1st November 2020 and runs until 30th April 2021.

2. Who can apply?

All SME’s can apply for a grant. Large businesses will need to meet a ‘financial assessment test’ to be eligible. The scheme is only available to those employers with a UK bank account and a UK PAYE scheme whose turnover is lower now than it was before experiencing difficulties as a result of Covid-19.

3. Can we apply if we didn’t use furlough?

Employers do not need to have made use of the Furlough Scheme to participate.

4. Can we still claim the Job Retention £1000 bonus in 2021?

Employers can use the scheme and still claim the Job Retention Bonus – if the eligibility criteria are met.

5. Do we need to get employee permission?

Employers will need to seek the agreement of employees to participate in the scheme under the same employment law principles applicable to the Furlough Scheme. So get agreement in writing.

6. Which employees can we use this scheme for?

Employees must be on an employer’s PAYE payroll on or before 23rd September 2020 (meaning that a RTI submission must have been made for the employee in question before that date)

7. What’s the minimum hours an employee must work?

For at least the first 3 months employees must work at least 33% of their usual hours

8. Can we use the scheme flexibly?

Employees will be able to come on and off the scheme – but each “short-time working arrangement” (ie period of 33% working under the scheme) must cover a minimum period of 7 days. Employees do not need to work the same pattern of hours each month.

9. Can we make employees redundant or issue notice whilst they are on the scheme?

Employees cannot be dismissed by reason of redundancy or put on notice whilst the employer is claiming under the scheme. (Employees would therefore have to be brought back to normal working hours before being given notice).

10. How do I claim the money back?

Claims will need to be for a minimum period of 7 days. Employers can only submit claims a month in arrears after employees have been paid and those payments have been reported via RTI. This means that you will have to fund the non-worked time costs upfront and then claim it back from the government

11. What does “usual hours” mean?

The assumption is that similar principles to the Furlough Scheme payment calculations will apply to hours i.e. usual hours are pre furlough hours

12. Who pays what? The complicated bit!!

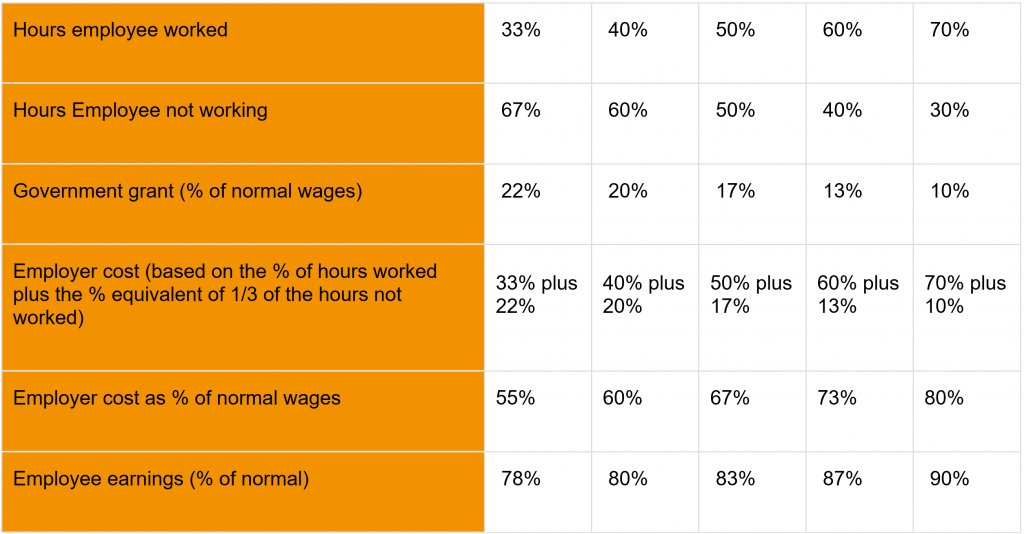

Unlike the furlough scheme, the JSS requires employers to pay the biggest share of the costs. You have to pay your employees for all of the hours they actually work at their normal rates of pay plus a percentage of the time they don’t work. The government will then chip in. This means that employees will be paid up to two-thirds of their usual wage for the time they don’t work.

The minimum you will pay is 55% of the employee’s wages and the maximum the government will pay is 22% (which is subject to a monthly cap of £697.92). This means that you will have to pay your staff at their normal rate of pay for the time they are not actually working. For example:

Plus, you will have to pay Class 1 employer NICs and pension contributions – the government will not contribute to these.